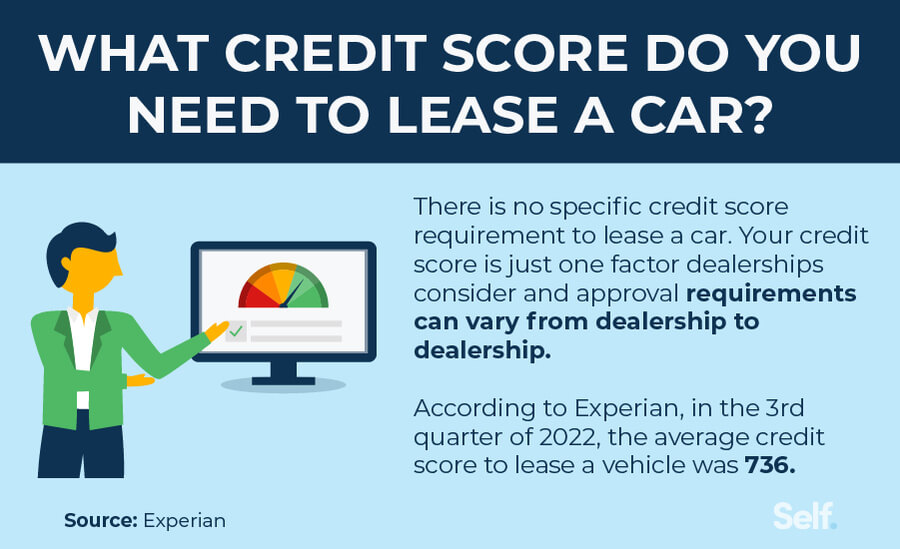

The average credit scores for those who got a lease at the in the first quarter of 2023 were 736, compared to 742 for new car financing and 677 for used car financing, according to the Experian State of the Automotive Finance Market report. When you lease, you're paying for the car's expected depreciation during the lease term, along with a.. No more complicated car loans, interest rates, juggling car payments, thinking about your credit score and credit checks, lease payments, or lease options. Unlike traditional leasing, car subscriptions don't require long-term contracts or large down payments, allowing you to remain flexible and use the car as needed without committing long-term.

Can I Lease A Car At 19

Where To Get A Car Loan

What Credit Score Do You Need to Lease A Car? Self. Credit Builder.

Can You Lease a Car With Bad Credit? Bad Credit Car Leasing Guide

No Credit Check Car Finance Carplus

No Credit check Furniture Same as cash Financing

Car Rental No Credit Check Uk Jarmite Car Rentals Home Facebook The car rental express

We All need to know about No Credit Check Car Insurance For 30 Days Key Points About this fact

Thinking About a Car Lease Payoff Know the Pros and Cons

carmeliamallegni

Which insurance companies don’t check credit scores? Natures Window

No Credit Check Car Loans Valley Auto Loans Valley Auto Loan Car loans, Loan, Credit check

What’s the minimum credit score to lease a car? LOANTUTE

What Credit Score Do You Need to Lease A Car? Self. Credit Builder.

Lizzie Bach

How To Buy Land With No Credit Check Homestead Survival Site

Barksdale Federal Credit Union Near Me No Credit Check Auto Lease

Do They Check Your Credit When You Lease A Car Car Retro

Finance Low Earnings

No Credit Check Car Loans How they work YouTube

According to NerdWallet, the exact credit score you need to lease a car varies from dealership to dealership. The typical minimum for most dealerships is 620. A score between 620 and 679 is near.. Pay bills on time and set up automatic payments wherever possible. Set up payment plans with creditors if necessary. Limit applying for new credit, as doing so requires a hard credit check, which.